AI-Mediated Conversations (AI-MC)

Redefining Bank’s Revenues Through its Call Center

Like several other banks in the EU reeling from the impact of the 2009 financial crisis, our client Bank (name withheld for confidentiality) had to take measures to restructure the non-performing loans under a parliament-approved securitization scheme. The Bank uses its in-house call center to contact non-performing loan debtors and negotiate offers to restructure the debt according to the debtor’s unique situation and their ability to pay-out the loan.

Given the effect of non-performing loans (NPLs) on its bottom line, the Bank was seeking a technology partner to help it optimize the collections process. Behavioral Signals partnered with this Bank and applied its AI-Mediated Conversations agent-customer matching technology towards maximizing the effectiveness of their Call Center.

AI and Finance

Financial institutions are leveraging AI systems in their contact centers for improved efficiency in delivering service to customers, helping them engage the customer uniquely. The ability to route and measure agent-customer interaction offers not only a higher probability of achieving the desired result, be it a sale or collection, but also insights on how AI is impacting the whole communication process.

Behavioral Signals proposed a model to optimize the call centers’ outcomes by using machine learning techniques to route the caller to the best-matching agent. By creating agent and customer behavioral profiles, from their past audio interactions, we were able to create a predictive model on which agents’ skills and overall behavioral traits during the calls are best suited for the specific customer in order to achieve the desired result.

From Voice to Revenue

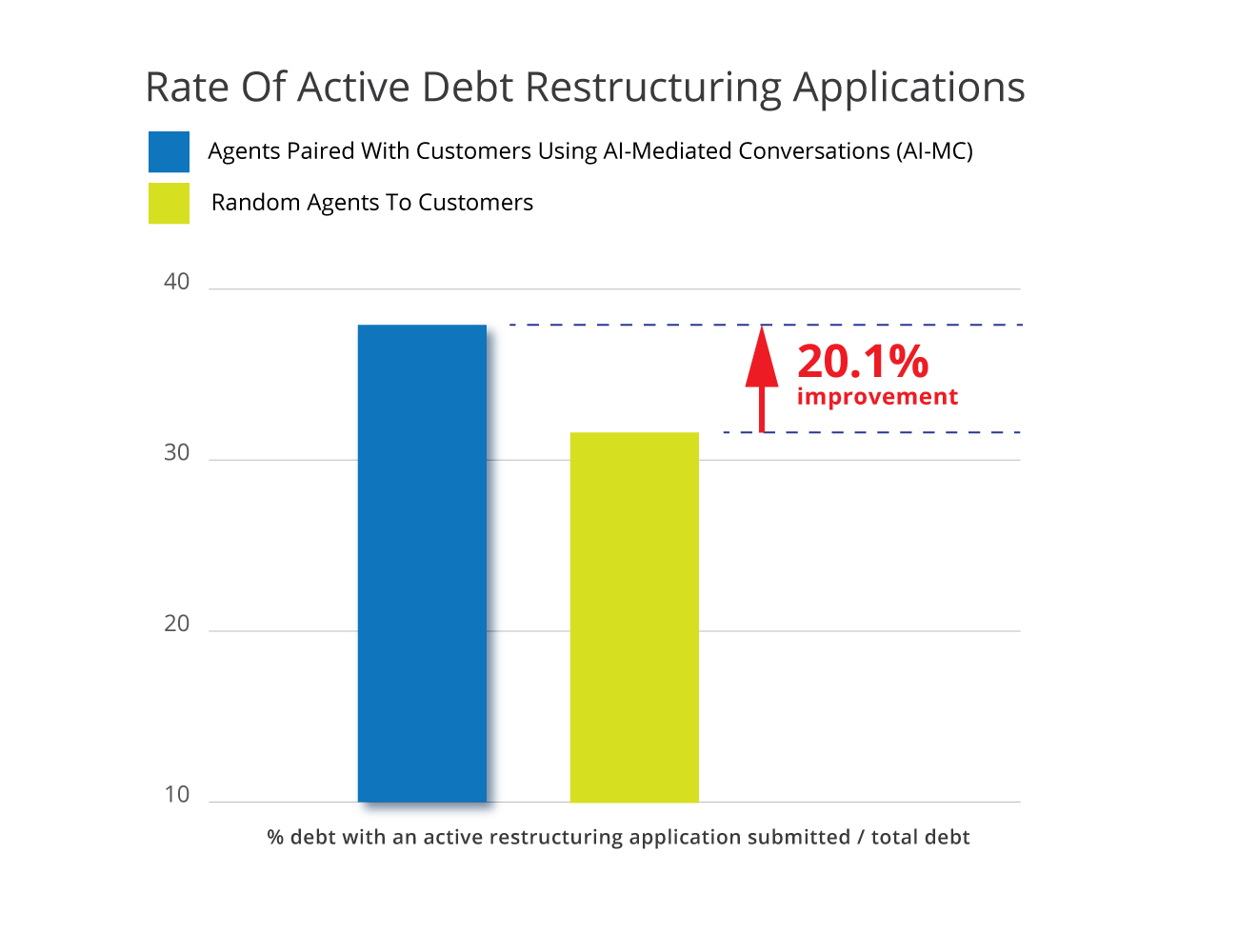

The solution was deployed on Live-Data in a champion/challenger setup demonstrating a significant return-on-investment with an actual increase of active revenue recovery/restructuring applications by 20.1% in total. On top of that, this improvement was essentially achieved with 7.6% fewer calls (Right Party Contacts), leading to additional cost reductions. In absolute numbers, these results actually correspond to approximately $7.5M USD of additional restructured debt for the Bank over the course of this evaluation and a potential $300M USD annual upside.

Digital Transformation in Banking

Contrary to a common concern, this drastic improvement of collection outcomes did not compromise the customer’s satisfaction levels. The Bank noted that these interactions have been smoother than average with the majority of interactions rated very high by the Bank’s QA team, clearly underscoring an improved ability of the agents to build rapport with their clients. Furthermore, these interactions provide excellent examples of successfully-handled interactions that can be used in training/ coaching of new and existing agents, thus improving the performance of the call center as a whole.

The Bank is extending the scope of cooperation with Behavioral Signals to deploy the AI-Mediated Conversations (agent-customer matching) application to the entire revenue recovery team along with other applications, to improve the efficiency and performance of its call center.

Need more information?

THE BANK

The client is a European (EU) Bank with 85% of the company’s pretax, pre-provision profits derived from its operations in its country of origin, complemented by 15% from Southeastern Europe. The financial group offers retail and corporate banking services. The Bank accepts deposits and offers loans, lease financing, mortgages, and investing and insurance services to industrial, commercial, and consumer clients.

IMPLEMENTATION

Virtual appliance on-premise

No external access, in compliance with Bank’s strict security protocols

Initial Diagnostic Review

RESULTS

– 20.1% INCREASE ON ACTIVE DEBT RESTRUCTURING APPLICATIONS

– 7.6% FEWER CALLS

– $7.5 MILLION USD OF ADDITIONAL RESTRUCTURED DEBT FOR THE BANK OVER THE COURSE OF THE EVALUATION

PROJECTED YEARLY UPSIDE:

– $1.5 MILLION PER AGENT PER YEAR

– $300 MILLION+ TOTAL RESTRUCTURED DEBT

TESTIMONIAL

“It’s impressive! While walking around at the call-center, one can immediately tell the difference between these agents and the others: the level of tension in their interactions is considerably lower”.

— Senior Call-Center Executive