AI-MC at FINANCIAL GROUP

Non-Performing Loans (NPLs) to the Test

A non-performing loan (NPL) is a bank loan that is subject to late repayment or is unlikely to be repaid by the borrower in full. Non-performing loans represent a major challenge for the banking sector, as it reduces the profitability of banks, prevents economic growth, and often has severe political ramifications. The 2008 global financial crisis became a politically sensitive topic in the EU member states, culminating in 2017 with the decision by the EU Council to task the European Commission to launch an action plan to tackle NPLs. The action plan supports the fostering of a secondary market for NPLs and the creation of Asset Management Companies.

José Manuel Campa, who leads the European Banking Authority (EBA) talked about the impact of COVID-19 on the European banking sector, the new stress tests, about how the EU banks should cope with an expected increase in NPLs. Read more >

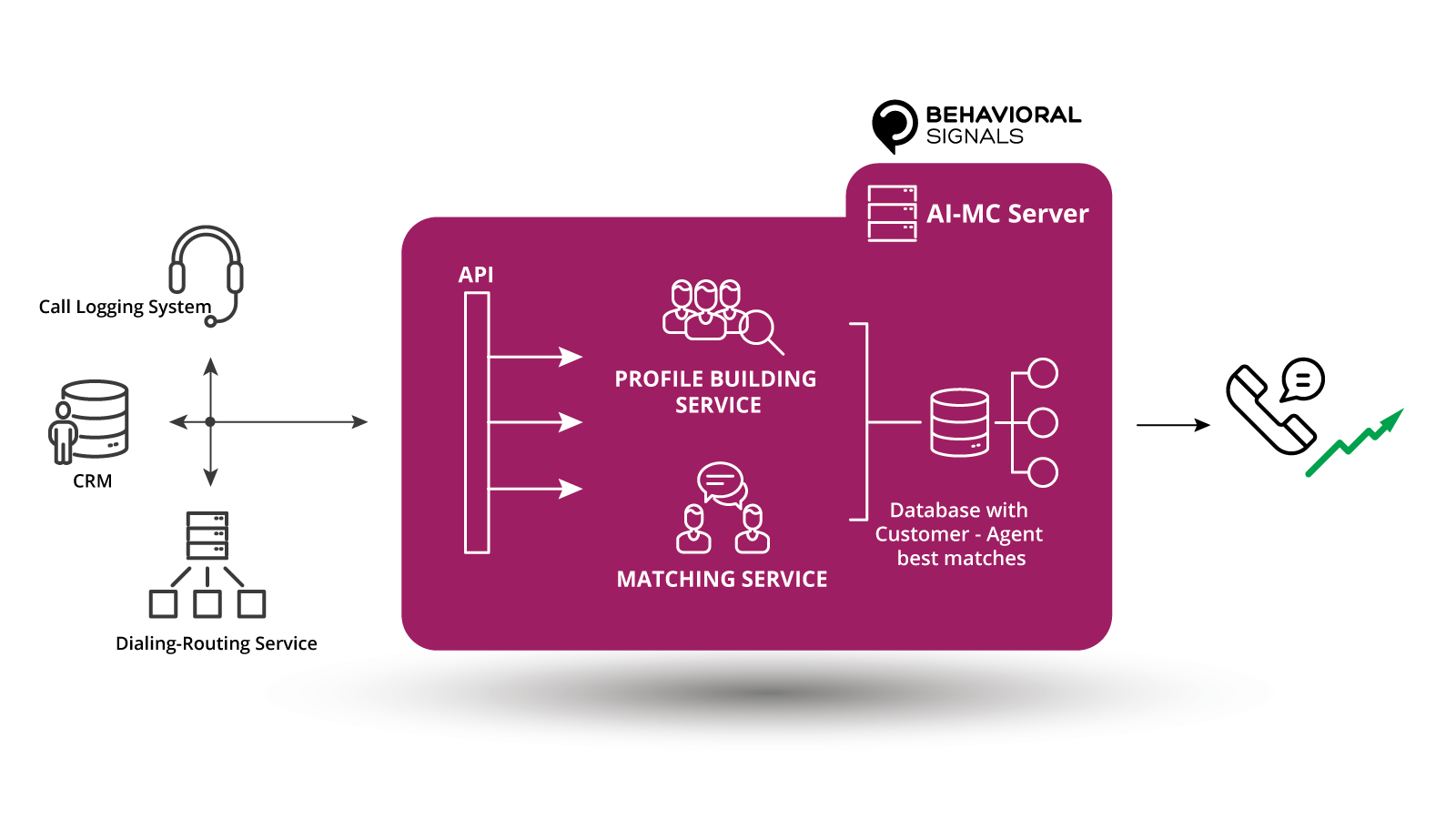

Our financial client was seeking an AI technology partner to help it optimize the collections process within its bank. Behavioral Signals partnered with the bank’s call center and applied its AI-Mediated Conversations agent-customer matching technology towards maximizing the effectiveness of their call center agents.

Matching the Customer to the Right Agent

AI-Mediated Conversations(AI-MC) is an automated call routing solution that uses emotion AI and voice data to match the customer to the best-suited agent to handle the specific call. This match is based on profile data and our superior algorithms developed from years of research and experience in natural language processing(NLP) and Behavioral Signal Processing.

Non-Performing Loans and AI-MC

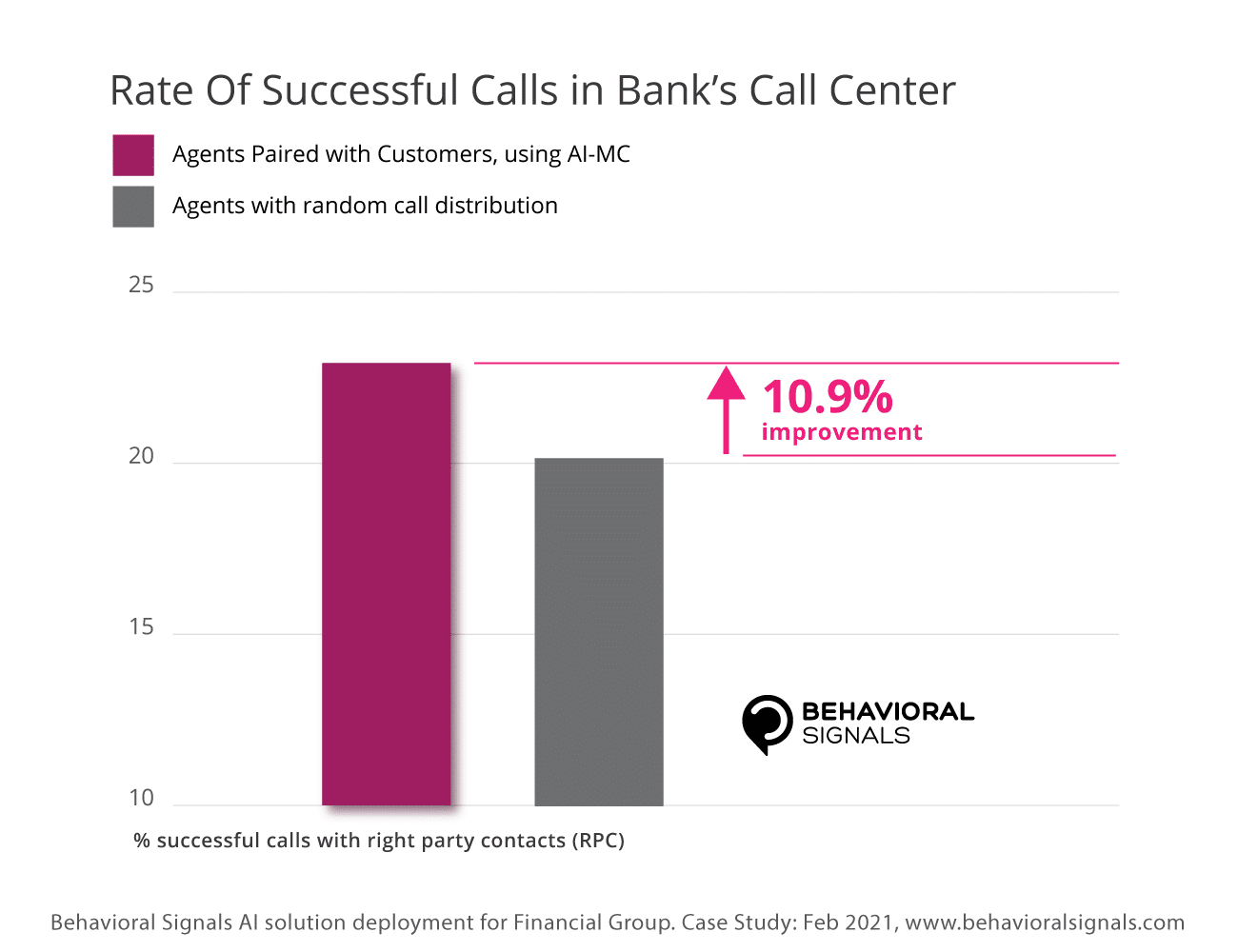

The solution was deployed on non-performing loans (NPLs) historic data, including metadata on actual payments. The portfolio included 11,959 customers with 154,655 calls. The call success ratio, for right party contacts (RPC), improved by 10.9%.

Calls were evenly distributed among the agents, without affecting their workload or call duration. 95% of the agents showed significant improvement in call success.

Next Steps

In discussion for integration

Need more information?

FINANCIAL GROUP

The bank is part of a European financial corporation that operates in the UK, Luxembourg, and the Balkans, with 653 physical locations and over 13,000 employees. Their employees at the non-performing loan (NPL) management division develop strategies for revenue management, settlement, and recovery. The bank maintains often contact with customers who have outstanding debts recommending the most suitable debt settlement.

IMPLEMENTATION

– Virtual appliance on-premise

– No external access, in compliance with the corporation’s strict security protocols

– Initial POV

RESULTS

– 10.9% INCREASE ON POSITIVE DEBT PAYMENTS

– CALLS EVENLY DISTRIBUTED AMONG AGENTS

– 95% IMPROVEMENT in CALL SUCCESS, ACROSS ALL AGENTS